Translate Website

Company

Marketing Completion Fund, Inc. is a media investment company formed to finance, develop, and distribute original and existing intellectual property (“IP”).

Vision

Our vision is to apply a Financing Risk Mitigation and Marketing Technology System to reduce risks investing in new intellectual property (“IP”) ventures and monetizes revenue globally.

Services

MCF provides professional services that include IP brand and technology development, capital formation structuring, financial modeling and capital raising, content development and production, marketing, sales, and distribution.

MCF will invest in IP developed by early stage companies in a range of industry sectors and provides professional consulting services to companies focused on IP technology.

Service pricing options are typically a combination of hourly rate, monthly retainer, commissions for product sales, and equity shares of company stock based on contribution to the anticipated company's growth in value.

Vision

Our vision is to apply a Financing Risk Mitigation and Marketing Technology System to reduce risks investing in new intellectual property (“IP”) ventures and monetizes revenue globally.

Services

MCF provides professional services that include IP brand and technology development, capital formation structuring, financial modeling and capital raising, content development and production, marketing, sales, and distribution.

MCF will invest in IP developed by early stage companies in a range of industry sectors and provides professional consulting services to companies focused on IP technology.

Service pricing options are typically a combination of hourly rate, monthly retainer, commissions for product sales, and equity shares of company stock based on contribution to the anticipated company's growth in value.

Current Projects

|

Business Development

Investor Lead Generation Chinese Investor Network Event - Hollywood Hat Trick

|

Investment Opportunities

|

Completion Fund Website

Over the last 5 years the MCF management team and clients have attended

250 event producers

15,000 direct contacts

250 event producers

15,000 direct contacts

Investor Wealth Builders Series

Polls of investors and investment professionals have been conducted to determine their ideal investment scenario. One of the common responses is the goal of achieving a double-digit total return in all economic environments.

At the Investor Wealth Builders Series we are going to explore exciting 2018 Innovation and investment diversification through asset class selection.

Our programming features innovative leaders in AI, Autonomous Vehicles , Blockchain, Cryptocurrency, Cyber Security, Healthcare, medical technology, Quantitative Funds, Robotics and Real Estate who will discuss what they do, and how to achieve in tech.

Who Should Attend?

This event is for high net worth, Family Office and accredited investors seeking to learn about investment opportunities and have capital allocation available for 2018.

At the Investor Wealth Builders Series we are going to explore exciting 2018 Innovation and investment diversification through asset class selection.

Our programming features innovative leaders in AI, Autonomous Vehicles , Blockchain, Cryptocurrency, Cyber Security, Healthcare, medical technology, Quantitative Funds, Robotics and Real Estate who will discuss what they do, and how to achieve in tech.

Who Should Attend?

This event is for high net worth, Family Office and accredited investors seeking to learn about investment opportunities and have capital allocation available for 2018.

Document PDF (Click to Download)

| iwbs_agenda_03-28-2017_10.pdf |

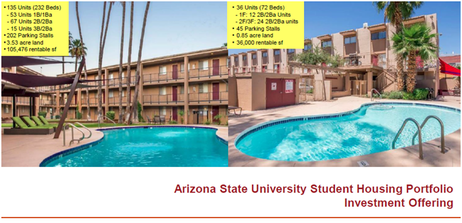

A Student Housing Investment Management Platform

An opportunity to invest with a privately-held investment operating company widely regarded as a leading student housing operator and investor focusing on the student housing sector.

The primary real estate focus is on acquiring core/core-plus, value-add and development student housing projects at Universities/Colleges with significant international student populations in the Western U.S.

The three founding members of the firm have closed over $17 billion transactions over their real estate As of January 2018 the company has closed 5 properties with an estimated completed value of approximately $200 million. Existing investors Include industry leading institutional foreign and domestic investors

Total assets under ownership and management estimated at approximately $390 million. The company is based in Downtown Los Angeles, California, is employee-owned, with one external investor from one of the largest family office in Asia

The primary real estate focus is on acquiring core/core-plus, value-add and development student housing projects at Universities/Colleges with significant international student populations in the Western U.S.

The three founding members of the firm have closed over $17 billion transactions over their real estate As of January 2018 the company has closed 5 properties with an estimated completed value of approximately $200 million. Existing investors Include industry leading institutional foreign and domestic investors

Total assets under ownership and management estimated at approximately $390 million. The company is based in Downtown Los Angeles, California, is employee-owned, with one external investor from one of the largest family office in Asia

Document PDF (Click to Download)

| asu_deck-2018-02-06__eng_.pdf |

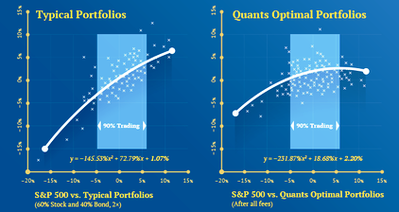

Alternative Fund - Quant Smart Beta Investing

Quants Inc (“Quants”) is a financial technology and asset

management company in Los Angeles, California since 2010.

Quants has built proprietary quantitative risk indices for smart beta investing with derivative overlays that can improve the portfolios to potentially deliver two times better distribution of monthly returns without tactical trading.

management company in Los Angeles, California since 2010.

Quants has built proprietary quantitative risk indices for smart beta investing with derivative overlays that can improve the portfolios to potentially deliver two times better distribution of monthly returns without tactical trading.

Document PDF (Click to Download)

| quants-summary-20170630.pdf |

FinTech Alternative Investment SAAS Platform

- QuantsPlus™ is a patent-pending automated alternative investment platform offering access to QIT™ - Quants Investment Technology with a SaaS (Software-as-a-Service) distribution model.

- QIT™ will analyze portfolios, determine the appropriate allocation of Quants Smart-Beta Building Block ETFs for an optimal portfolio and rebalance them automatically over time.

- QuantsPlus™ will help financial advisors and individual investors generate better risk-adjusted investment returns by leveraging technology and algorithms who want next-generation alternative investment services and products.

- The alternative investment platform is built for financial advisors and institutional partners to accelerate client growth, retention, and better portfolio ROI.

- Financial Advisors and Digital Advice partners will have an easy to integrate and embeddable Advisor brandable widgets to provide access for their clients to analyze and optimize portfolios with the QIT™ - Quants Investment Technology.

- Individual Investors will be able to access the easy to use QIT™ - Quants Investment Technology to analyze and optimize portfolios on the platform.

Document PDF (Click to Download)

| quants-fintech-deck-20171106.pdf |

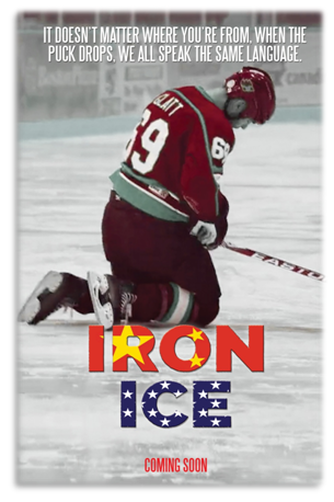

China - U.S Cross Border Entertainment and Technology

MCF is developing and financing the Iron Ice film and Hat Trick lifestyle brand intellectual properties (IP) targeting the China, U.S. and global entertainment ($2.2 trillion) and sports ($1.5 trillion) markets.

Mission

Our mission is to build cultural bridges and economic development with entertainment and sports diplomacy by developing profitable entertainment projects and film stories that tell a universal theme that applies to anyone regardless of cultural differences or geographic location.

Iron Ice Feature Length Film

The IRON ICE feature length film is a compelling drama set against the expansive backdrop of Beijing, China, the Mesabi Iron Range in Minnesota, and the Minnesota State High School Boys Hockey Tournament and features a Chinese national immigrant with his family settling in Minnesota as the head of the family accepts an important position with a multi-national iron mining company. The oldest son bonds with a local of many generations through youth hockey and helps the team win the Minnesota State High School Boys Hockey Tournament.

Mission

Our mission is to build cultural bridges and economic development with entertainment and sports diplomacy by developing profitable entertainment projects and film stories that tell a universal theme that applies to anyone regardless of cultural differences or geographic location.

Iron Ice Feature Length Film

The IRON ICE feature length film is a compelling drama set against the expansive backdrop of Beijing, China, the Mesabi Iron Range in Minnesota, and the Minnesota State High School Boys Hockey Tournament and features a Chinese national immigrant with his family settling in Minnesota as the head of the family accepts an important position with a multi-national iron mining company. The oldest son bonds with a local of many generations through youth hockey and helps the team win the Minnesota State High School Boys Hockey Tournament.

Document PDF (Click to Download)

| iron_ice_china_-_u.s._cross_border_entertainments_project_12-11-2017.pdf |

IP Technology Investment - Risk Mitigation System

MCF has developed a Financing Risk Mitigation and Marketing Technology System to reduce risks investing in new intellectual property (“IP”) ventures and monetize the revenue opportunities globally.

The first project and investment opportunity utilizing the Financing Risk Mitigation and Marketing Technology System is the Iron Ice feature film and Hat Trick lifestyle sports brand intellectual properties (“IP”) targeting the China, U.S. and global entertainment and media ($2.2 trillion) and sports ($1.5 trillion) markets.

MCF has developed an investment structure to invest in motion pictures that has the potential to earn substantial returns. The film can earn revenue from box office receipts and ancillary rights sources of income. These sources include merchandising rights, television spin-off rights, home video, sequel, prequel and remake, book publishing rights, computer game rights, soundtrack album rights, and the music publishing rights in the score.

The features of the Capital Structure and Marketing Technology System are to:

The first project and investment opportunity utilizing the Financing Risk Mitigation and Marketing Technology System is the Iron Ice feature film and Hat Trick lifestyle sports brand intellectual properties (“IP”) targeting the China, U.S. and global entertainment and media ($2.2 trillion) and sports ($1.5 trillion) markets.

MCF has developed an investment structure to invest in motion pictures that has the potential to earn substantial returns. The film can earn revenue from box office receipts and ancillary rights sources of income. These sources include merchandising rights, television spin-off rights, home video, sequel, prequel and remake, book publishing rights, computer game rights, soundtrack album rights, and the music publishing rights in the score.

The features of the Capital Structure and Marketing Technology System are to:

- Reduce levels of risk investing in new IP ventures.

- Generate customers and revenue PRIOR TO PRINCIPAL PHOTOGRAPHY.

- Generate revenue projected to be $5,000,000 in 30 months, $60,000,000 in 60 months, and over $300,000,000 in 120 months From feature films, animated series, books, eCommerce subscriptions, mobile games, AR/VR, events lead generation merchandise, travel marketing, celebrity charity events, youth fund raisers and other categories.

Document PDF (Click to Download)

| mcf_ppt_master_slides_2-17-2018.pdf |

Hollywood Hat Trick

- Hollywood Hat Trick is a Sports, Entertainment and Tech Festival and Expo with Celebrity Games and Awards Gala.

- HHT provides an opportunity for the community to raise funds for non-profits on a local and national level.

- Previous beneficiaries have included Toys For Tots, Minnesota Sports Association, and Mariucci Inner City Hockey Association.

- The celebrity teams are comprised of current and alumni professional players, Hollywood celebrities that play hockey, basketball and soccer, in addition to players from the community at large.

- The tournament teams are comprised of the youth, high school, college players, professional sports alumni, and film, TV, sports, political and business celebrity players.

Document PDF (Click to Download)

| hollywood_hat_trick_power_point_10-14-2017_10.pdf |

Detroit Hat Trick

The Detroit Hat Trick featuring the:

- Hollywood Hat Trick Celebrity Hockey Charity Game - Detroit All-Stars vrs. Hollywood All-Stars. This event location

- One Hockey "Guinness World Record Attempt" Youth Hockey Tournament with support from MAHA - Michigan Amateur Hockey Association

- Fan Festival that provides new sports technology experiences in AR, eSports and opportunity to meet the professional, college and associations sports teams.

- Tech Expo and Job Fair to showcase new technologies and connect companies to great talent

- VIP Party with Detroit and Hollywood Sports, Business, Technology Community Leaders.

- Awards Gala and Banquet honoring Detroit, Michigan, and Global Business Leaders that have contributed to the development of City of Detroit and Michigan.

Company Experience

The management team, advisors, consultants, and partners are comprised of individuals and companies that have extensive experience in Capital Formation Structuring, Financial Modeling, and Capital Raising, China M&A, Digital Marketing, Entertainment, Film Financing, Production and Distribution, IP Brand and Technology Development, Marketing Technology, Product Development, Semiconductor Plant Manufacturing, Software Development, Sports, AR/VR Technology Labs, and Wealth Management.

- Technology – Developed AR/VR technology for United States government agencies and built semiconductor plants in United States and Taiwan.

- Capital – Developed innovative capital formation structures and capital raising strategies. Provided services to 234 securities engagements totaling $2,173,809,195 in capital raised.

- Films – Experience in the acquisition and selling of $5 billon of film content for major studios, successfully produced and distributed independent feature films, and documentaries.

- Games – Developed sports games for Activision, EA, Midway, and Sony that generated $1.5 billion in sales. Developing next generation AR/VR games and eSports experiences.

- Lead Generation – Digital marketing and call center services for financial service companies and consumer brands.

Projects 2015 – 2017

|

|